BUSINESS ADVISORY SERVICES

iDeCK provides strategic and financial consulting services to clients that include Governments, regional and global organizations, and corporates. We have rich experience in helping clients steer through various economic cycles – boom, slowdown, and cautious revival phase. Our team has offered innovative solutions for infrastructure development from concept to implementation – contributing across the entire project lifecycle.

We understand the long term nature of infrastructure contracts, and support our clients on projects that are bankable and sustainable. We focus on an equitable distribution of risks and responsibilities. We offer assistance to clients in their decision making process, ensuring a robust project that also attracts private capital.

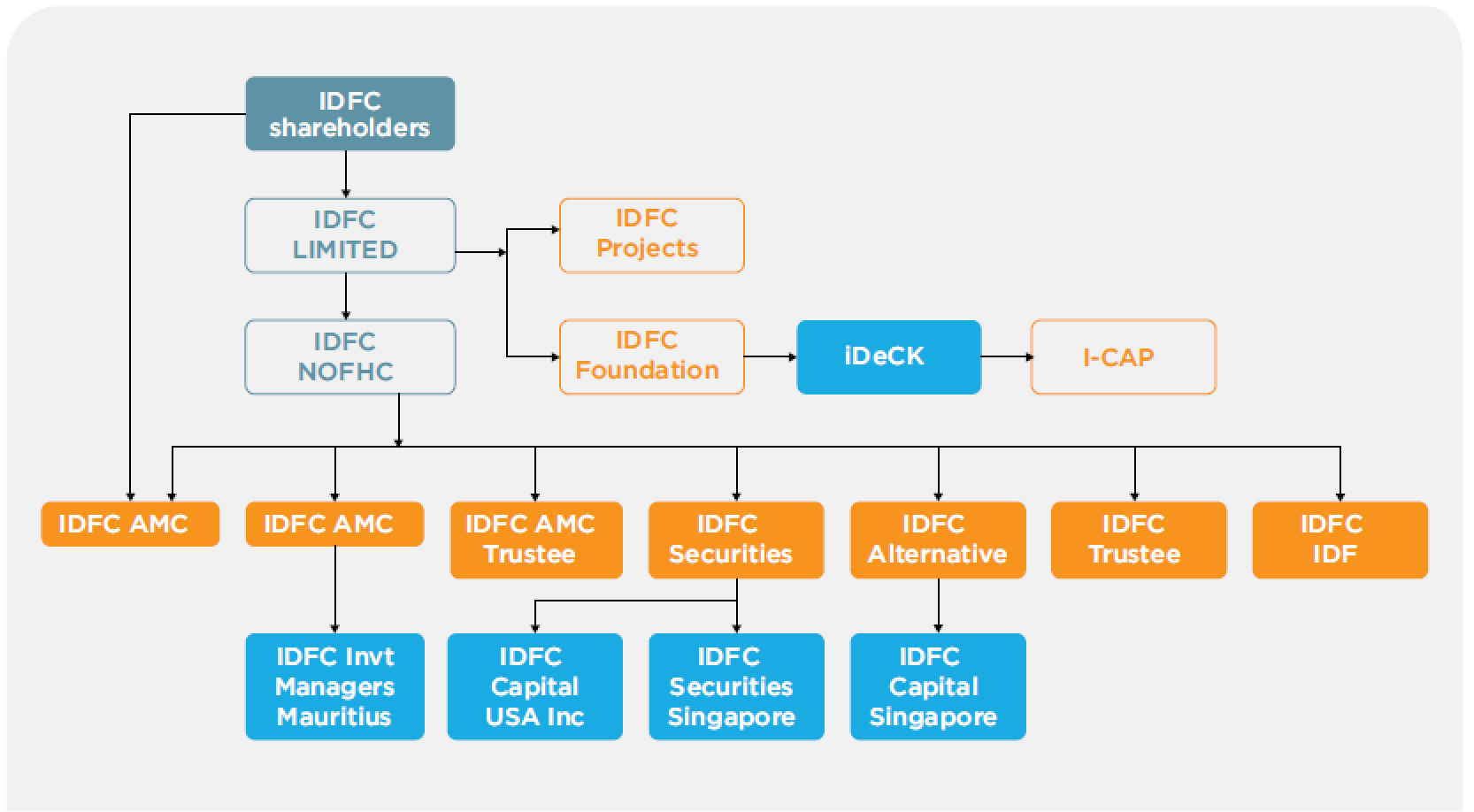

iDeCK works closely with the various arms of IDFC, our parent organization in delivering advisory services engagements to ensure high quality of deliverables.

Given IDFC’s experience with projects (either by way of debt or equity), this engagement gives us deep insights into the thinking of various stakeholders across the project life cycle. The IDFC institute is a think-tank working exclusively in the area of policy, institutional reform and governance. This body of knowledge within the IDFC ecosystem is leveraged at a no-cost-to-client basis by different business groups and practice areas within iDeCK.

We put together a diverse and dedicated multi-disciplinary team for each assignment. Each member goes through extensive training to deliver high quality, implementable solutions. The mix helps us to adopt a creative and cross-functional approach, which has been well-appreciated by all our clients.

Services Offerings

- Policy preparation

- Sector strategies (national and sub-national)

- Urban finance strategies and frameworks

- Tariff frameworks

- Economic impact assessment

- Financial feasibility studies

- Risk identification and mitigation strategies

- Project structuring

- Contract documentation

- Transaction advisory services for implementation of PPPs

- Programme management support

- Business plans

- Fund syndication

- Bid process management

- Bid documentation

Business Practice Verticals

URBAN

TRANSPORTATION

ENERGY

TOURISM

IT & eGOVERNANCE

HEALTHCARE

SKILLS & EDUCATION

INFRASTRUCTURE & TECHNOLOGY

SKILL DEVELOPMENT & CAPACITY BUILDING

Business Consulting

Entry Strategy

This could be leveraged by a business operating in India in one domain, and looking at entering newer spaces outside of their current operations. This could also benefit entities outside of India, interested in entering the infrastructure space in India. With our extensive experience, we are best poised to offer advice on business, economic, and political factors that could impact investment decisions.

Business Plans / Restructuring

Given our domain expertise and understanding of operations, we are well positioned to assist in the preparation of business plans/restructuring of companies to redirect their focus and turn them around for profitability. We have been involved in the restructuring of four Government promoted entities in India.

iDeCK’s Business Advisory Group focuses on the corporate sector, helping clients enhance their competitiveness along the various segments of their value chain. We provide consulting services in strategy, policy advisory, operations improvement and corporate finance. A large part of our corporate clients is spread across these eight industry verticals.

- Urban

- Transportation

- Energy

- Tourism

- IT & eGovernance

- Healthcare & Lifesciences

- Skills & Education

- Infrastructure & Technology

Our clients include Government departments, multilateral organizations, corporates, family-managed businesses and industry associations.

Financial Advisory

We take on financial structuring of a project, including sourcing of finance and risk mitigation.

Debt Restructuring

Given our background, we have regular deep interactions with various investors such as banks and financial institutions. Our team undertakes project appraisals for our internal purposes from an investment perspective and also manages funding mandates for corporates and Governments. We also handle debt structuring activities, essential to lower stress on cash flows ensuring that projects remain as standard assets with their financiers.

Fund Syndication

Corporates have large funds requirements by the way of debt and equity for timely financial closure of their projects. iDeCK has a full-fledged syndication, structuring and advisory division (BAG) offering a wide range of financial services. BAG has a team of qualified professionals, equipped to address the special needs of clients’ and provide smart solutions. The team takes a transparent approach and a balanced view on the risk perceptions of projects. Our service offering includes:

- Rupee Debt Syndication (term loan and working capital)

- Underwriting of debt

- Arranging ECB, FCCB, ECA and other types of FC funding

- Equity syndication/placement of private equity

- Arranging M&A funding

- Private placement of bonds/debentures/preference shares

- Appraising and structuring of financial packages

Feasibility

We undertake feasibility studies to determine a project’s viability, helping clients make a decision on whether to proceed with the project. Typical studies cover aspects such as markets, competition, project cost, revenue projections, returns, risks and the legal and regulatory environment.

Project Structuring

Project structuring involves addressing concerns and meeting the requirements of diverse stakeholders, addressing legal and regulatory issues, and capital structuring. This is converted into contracts that clearly define roles, responsibilities, and risks allocated to each partner.

PPP Advisory

Our team brings unique ideas; effective marketing to potential bidders along with transparent, well-documented and quick processes that ensure the best long-term value for Government entities when they structure Public-Private Partnership projects. We also offer advisory services to private sector clients planning to bid for infrastructure projects through PPP.

Transaction Advisory including Due Diligence, Valuations, Economic Analysis

iDeCK takes a holistic approach to Transaction Advisory that reflects a thorough knowledge of the individual activities and how, integrating these activities can impact a transaction leading to its success.

While investors need accurate information to make critical decisions, such information is not readily available and is often difficult to evaluate. The success of a deal may hinge on the ability to discover and analyse these hard-to-find insights.

Strategic Initiatives and Special Projects

We offer technical, financial, and commercial due diligence for projects on behalf of investors, lenders, and investees.

We collaborate with you to understand the objective of the transaction and define the best possible roadmap to take project forward. We advise you during the initial evaluation by discussing the transaction structure, the financial terms, outlining the preferable terms and suggesting various alternatives. Based on our understanding the objective and the prevailing regulatory environment, we suggest possible options/structures. We will flag issues that arise from our understanding of the various aspects governing a possible transaction to ensure effective decision making from your end.

iDeCK is the fund management agency for PDF (Project Development Fund) earmarked for infrastructure project development, and vested (with iDeCK) by the Government of Karnataka. iDeCK initiates the development of infrastructure projects (in association with other Government agencies) to be implemented through private participation.

iDeCK identifies infrastructure projects (in association with Government agencies) that could be implemented through private participation. The PDF is then utilized in:

- Defining the scope of services for project preparation studies

- Technical studies

- Demand studies

- Financial viability analysis

- Project structuring for private participation

- Bid documentation

- Bid process management including project marketing to prospective bidders

- Assistance to the Government agencies in negotiations and agreement, with the selected private developer

Governments & Multilaterals Group

Helping Governments achieve better efficiency

iDeCK’s Business Advisory Group focuses on helping governments enhance their efficiency, impact, and outcomes at various levels. We do this by offering assistance in institutional reform, governance, and capacity building in Government departments/organisations. We work with Governments at all levels – local, state, national and International. The functional nature covers policy, long term planning, administration and control, fiscal management, and e-governance.

We have a talented core team of in-house consultants, an extensive database of on-call external experts, and partnerships with various collaborating institutions.

We catalyse a synergy of natural and social sciences, engineering and management, to provide clients with cutting edge consulting solutions.

Reflecting this, the group’s technical assistance and consultancy services range from single-person projects to full-fledged teams. We have proven expertise in handling projects varying from a few days, to several years.

With a track record of over 700 consulting assignments, iDeCK services clients in SAARC and other countries across South East Asia and Africa.

Within the Government & Multilaterals Group, one area of focus is our Development Consulting Practice which provides services across the entire development spectrum. Its expertise spans social (education, health, livelihoods, poverty, resettlement & rehabilitation), technical (environment, energy efficient, renewable energy, forest management) and sustainability services (disaster management, risk mitigation, climate change, and corporate social responsibility).

Key Project Experience

ROADS

RAIL

PORTS

AIRPORT

LOGISTICS

WATER & WASTE WATER

SOLID WASTE MANAGEMENT

SANITATION

URBAN TRANSPORT ( RAIL BASED )

GROUND MOUNTED SOLAR

ROOFTOP SOLAR